When I started my first business, I remember sitting at my desk surrounded by receipts, forms, and a growing sense of uncertainty about filing taxes. I thought I knew everything about taxes – but filing small business taxes for the first time was still an eye-opening experience. There were so many things I wish someone had told me back then.

Now, after helping hundreds of small business owners through their first tax season, I want to share what I’ve learned to make your first business tax filing simpler and less stressful. This guide walks you through everything you need to know – from essential documents to key deadlines and common pitfalls to avoid.

Understanding Business Tax Basics

During my years providing accounting services, I’ve noticed that many new business owners get overwhelmed because they don’t understand their tax obligations. Let me break this down the way I wish someone had explained it to me.

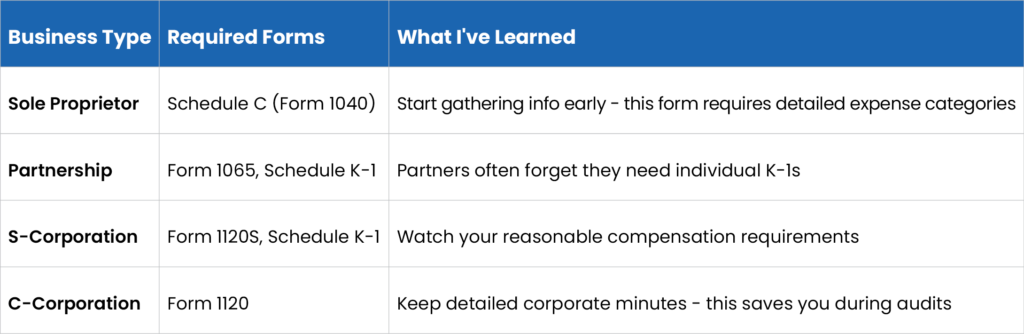

Your tax requirements depend on how you structured your business:

- If you’re a sole proprietor, you’ll report your business income on Schedule C with your personal tax return

- For partnerships, you’ll need Form 1065 – I help several clients navigate this annually

- S-Corporations file Form 1120S

- C-Corporations file Form 1120

What Do I Need To File My Business Taxes?

I learned this lesson early: organization is everything. Here’s the document checklist I now use with all my first-time tax clients:

Financial Records

I tell my clients to think of these as telling their business’s financial story:

- Business bank statements

- Credit card statements – separate business from personal

- All those receipts you’ve been collecting (yes, every single one matters)

- Income records (my tip: create a simple spreadsheet to track these monthly)

- Vehicle mileage logs if you use your car for business

Business Documentation

These are your business’s identity papers:

- Your EIN

- Business formation documents

- Licenses and permits

- Partnership agreements if applicable

Financial Statements

This is where quality bookkeeping services make all the difference. You’ll need:

- Profit and loss statement

- Balance sheet

- Cash flow statement

How To File My Business Taxes For The First Time

Let me share the process I’ve refined over years of helping first-time filers:

Step 1: Choose Your Filing Method

I typically recommend these options based on your comfort level:

- E-file through QuickBooks

- File electronically through an IRS-approved provider

- Mail paper forms – though it’s not really recommended anymore

- Work with a tax professional

Step 2: Gather Required Forms

I’ve found that knowing which forms you need upfront saves hours of stress later. Here’s what you need to prepare:

Step 3: Calculate Your Tax Liability

This step used to keep me up at night when I first started. Now I know it’s all about breaking it down into manageable pieces:

- Income tax on business profits – track this monthly

- Self-employment tax – set aside 15.3% of your profits

- Estimated tax payments

- Employment taxes for your team

For more detailed guidance, visit our small business tax tips blog where we share advice on tax calculations and money-saving strategies.

Important Tax Deadlines

I learned about tax deadlines the hard way in my first year. While these are the standard tax deadlines, remember that exact dates can change year to year based on weekends, holidays, and special circumstances. Always verify current deadlines through the IRS website or your tax professional.

January

- January 15: Fourth quarter estimated tax payment for previous tax year

- January 31:

- File Form W-2 for employees

- Submit Forms 1099-NEC for independent contractors

- File Form 940 for annual federal unemployment tax

- File Form 941 for fourth quarter payroll taxes

- Provide 1099s and W-2s to recipients

Pro Tip: Block out the last week of January for these forms. They’re too important to rush.

February

- End of February: Paper file Forms 1099 and 1096 with IRS

- End of February: Paper file Form W-3 with Social Security Administration

March

- March 15 (or next business day):

- S-Corporation tax returns (Form 1120S)

- Partnership tax returns (Form 1065)

- Last day to file for 6-month extension

Quick Note: If March 15 falls on a weekend, the deadline moves to the next business day.

April

- April 15 (or next business day):

- C-Corporation tax returns (Form 1120)

- First quarter estimated tax payment

- Individual tax returns with Schedule C

- Last day for previous year’s IRA contributions

- April 30: File Form 941 for first quarter payroll taxes

June

- June 15 (or next business day): Second quarter estimated tax payment

- June 30: File Form 941 for second quarter payroll taxes

September

- September 15 (or next business day):

- Third quarter estimated tax payment

- Extended S-Corporation returns

- Extended Partnership returns

- September 30: File Form 941 for third quarter payroll taxes

October

- October 15 (or next business day):

- Extended C-Corporation returns

- Extended individual returns

December

- December 31:

- Last day for tax-deductible purchases for current tax year

- Final day to pay expenses for cash-basis taxpayers

- Deadline for most retirement plan contributions

Understanding Date Adjustments

- When a deadline falls on a weekend or legal holiday, it moves to the next business day

- The IRS may extend deadlines due to natural disasters or special circumstances

- State tax deadlines might differ from federal deadlines

Time-Tested Deadline Management Tips

- Set three reminders for each deadline:

- 30 days before: Start gathering documents

- 14 days before: Review for missing items

- 7 days before: Final check and submission

- Build in buffer time:

- Add an extra week for mailed forms

- Plan for potential technology issues

- Consider holiday and weekend adjustments

Tax Deductions You Shouldn’t Miss

After years of helping small business owners, I’ve noticed many commonly overlooked deductions. Here’s what you should know about:

Home Office Expenses

If you have a dedicated home office for your business, here are some potential deductions you shouldn’t overlook:

- A portion of your rent or mortgage – based on your office’s square footage

- Percentage of utilities used in your work space

- Relevant portion of home insurance

- Office-related repairs and maintenance

Quick tip: The IRS has specific requirements for claiming home office deductions. Your workspace must be used regularly and exclusively for business to qualify.

Business Equipment

- Computers and technology

- Office furniture

- Business machinery

- Point-of-sale systems

- Equipment maintenance and repairs

- Software subscriptions

Professional Services

- Legal fees

- Accounting fees

- Consulting services

- Professional licensing fees

- Business coaching

- Technical training

Marketing and Advertising

- Website development and maintenance

- Business cards and printed materials

- Online advertising costs

- Social media marketing expenses

- Networking event fees

- Trade show participation

Vehicle and Travel Expenses

- Business travel costs

- Vehicle expenses for business use

- Parking fees for business purposes

- Client meeting travel expenses

- Conference attendance costs

Employee and Contractor Costs

- Payroll expenses

- Employee benefits

- Contract labor

- Worker training programs

- Employee education reimbursements

- Team building activities

Download our financial ratios cheat sheet to help track these expenses effectively and identify additional tax-saving opportunities.

Common First-Time Filing Mistakes

Through years of helping small business owners with their taxes, I’ve identified several common pitfalls. Here’s what to watch out for:

- Documentation Gaps

- Always keep your receipts (digital or physical)

- Set up an organized record-keeping system

- Save backup copies of important documents

- Track all business transactions systematically

- Keep business and personal expenses separate

- Income Reporting Oversights

- Track all revenue streams

- Record cash transactions immediately

- Document any bartered services

- Keep records of all payment methods

- Save copies of all invoices issued

- Business Classification Errors

- Double-check your business structure classification

- Use the correct tax forms for your entity type

- Apply the right tax rates for your business

- Keep formation documents current

- Maintain required business licenses

- Missing Important Deadlines

- Create a tax deadline calendar

- Plan for quarterly payments if needed

- Allow extra time for document gathering

- Note extension deadlines if applicable

- Schedule regular tax planning reviews

Tax Planning Strategies

Here are proven strategies to make future tax seasons easier:

- Systematic Record Keeping

- Choose appropriate accounting software

- Create a digital backup system

- Implement regular bookkeeping routines

- Keep supporting documentation organized

- Review records monthly

- Separate Business Activities

- Open a dedicated business bank account

- Get a business credit card

- Track all business transactions separately

- Maintain clear expense categories

- Document business purpose for expenses

- Professional Support

- Consider working with a tax professional

- Keep up with tax law changes

- Plan for business growth

- Schedule regular financial reviews

- Build a relationship with financial advisors

Getting Professional Help

While you can file business taxes on your own, working with a professional offers several benefits:

- Accurate tax preparation

- Maximum deduction identification

- Strategic tax planning

- Time savings

- Reduced audit risk

Consider working with a qualified tax professional who can guide you through your first filing and help establish good tax practices for the future.

Next Steps For Your First Business Tax Filing

Start preparing now:

- Organize all your business documents

- Create a reliable record-keeping system

- Mark key tax deadlines on your calendar

- Evaluate if you need professional help

- Review your business structure for tax efficiency

Filing small business taxes for the first time takes preparation and attention to detail. By following this guide and staying organized, you can complete your first business tax return accurately and on time.

Ready To Make Your First Business Tax Filing Easier?

At Ledgerment, we know that filing small business taxes for the first time can be complex. Our team of CPAs and tax professionals helps small business owners like you file with confidence.

Our services include:

- Tax return preparation and filing

- Year-round tax planning

- Business expense tracking

- Financial statement preparation

- QuickBooks setup and support

Don’t wait until the tax deadline approaches. Let’s work together to make your first business tax filing a success.

FAQs About First-Time Business Tax Filing

Do I need to file taxes if my business didn’t make money?

Yes, you should file a return even if your business operated at a loss.

Can I deduct startup costs?

Yes, you can deduct up to $5,000 in startup costs in your first year.

Should I file quarterly estimated taxes?

If you expect to owe $1,000 or more in taxes, you should make quarterly estimated payments.

What records should I keep after filing?

Keep all tax records for at least three years from the filing date.

Do I need a tax professional to file my business taxes?

While not required, a tax professional can help you maximize deductions, avoid mistakes, and save time. They’re particularly valuable in your first year.

Do I need to keep paper receipts?

Digital copies are acceptable as long as they’re clear and show the date, amount, and business purpose of the expense.