Every dollar saved in taxes directly impacts your business’s bottom line. Our Texas CPAs have helped hundreds of small businesses discover substantial tax savings through legitimate deductions many owners overlook. When it comes to creative tax deductions for small business, our guide walks you through both common and innovative strategies that could save your business thousands each year.

Understanding Tax Deductions

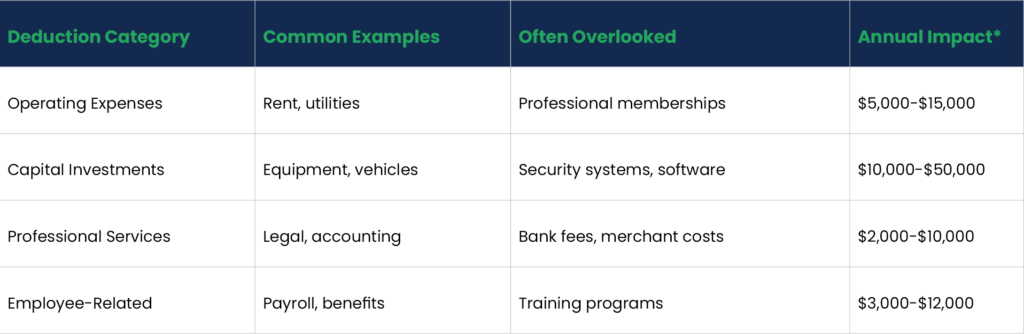

Before diving into specific deductions, understanding how they fit together helps you build a comprehensive tax strategy. Let’s look at the main categories and their potential impact on your business:

*Based on typical savings reported by our Texas small business clients

Implementation Guide

Success with creative tax deductions for small business starts with proper systems and documentation. Many businesses lose thousands in legitimate deductions simply because they lack proper records. Here’s how to avoid that costly mistake:

- Start with Your Foundation:

- Set Up Your Systems

- Choose accounting software (QuickBooks or Xero)

- Implement receipt tracking (Dext)

- Establish regular review schedules

- Create backup procedures

- Document Everything

Your documentation system needs three key elements:

- Digital receipt storage

- Purpose notes for expenses

- Clear business justification

- Regular backups

Core Business Deductions

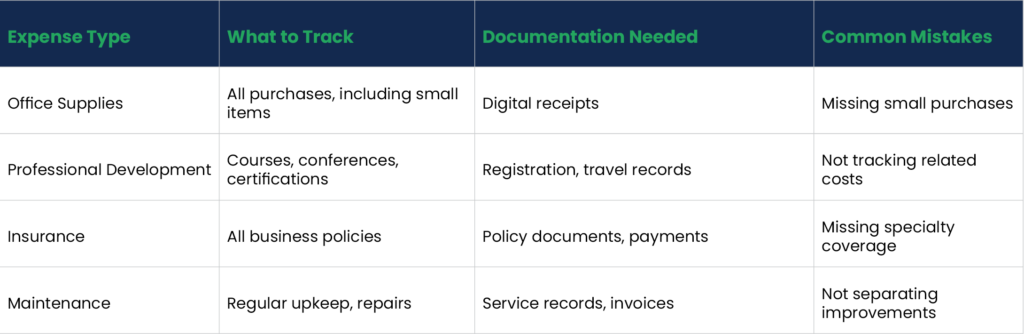

Understanding and maximizing core deductions forms the foundation of effective tax planning. These deductions apply to most businesses, regardless of industry or size.

Operating Expenses

Operating expenses typically represent your largest deduction category. While most businesses track obvious expenses like rent and utilities, many overlook valuable deductions in day-to-day operations.

Essential Operating Deductions:

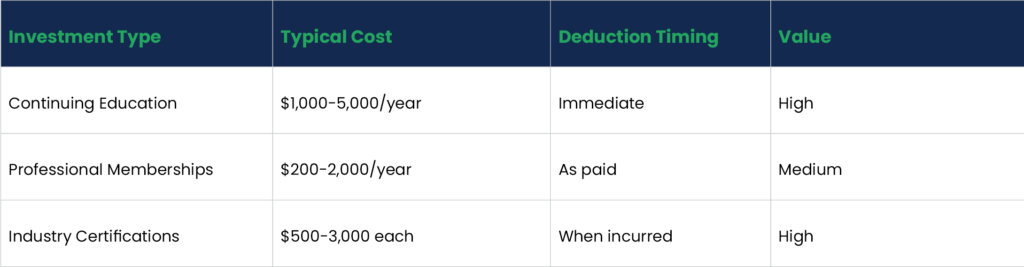

Professional Development Deep Dive:

Most businesses don’t maximize their professional development deductions. Beyond basic training, you can deduct:

- Industry conference attendance

- Online learning subscriptions

- Professional certification costs

- Required continuing education

- Industry-specific training

Real Example: A Texas service business saved $3,500 annually by properly tracking all professional development expenses, including related travel and materials costs.

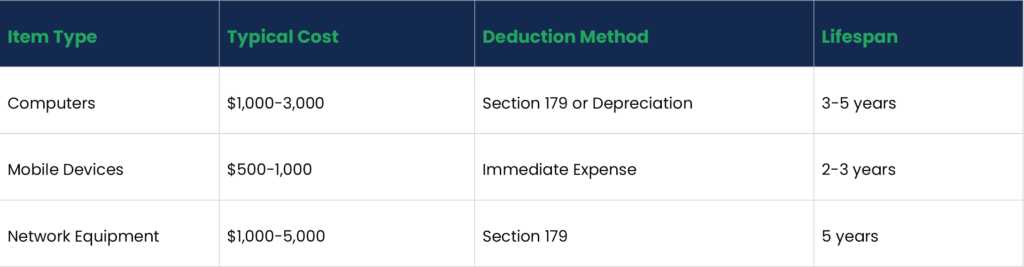

Technology and Software

Modern businesses seeking creative tax deductions for small business opportunities should pay special attention to technology investments. These investments create valuable deductions while improving efficiency.

Essential Technology Stack:

- Core Business Software

- Accounting platform (QuickBooks or Xero)

- Receipt management (Dext)

- Industry-specific tools

- Security software

- Hardware Investments Your hardware purchases might qualify for immediate expensing or depreciation. Track these purchases carefully:

Home Office Deductions

The home office deduction offers significant savings when handled correctly. Two calculation methods exist, each with distinct advantages:

Simplified Method:

- $5 per square foot

- Maximum 300 square feet

- $1,500 annual maximum

- Minimal documentation

Regular Method:

- Percentage of home expenses

- No maximum deduction

- Includes depreciation

- Requires detailed records

Pro Tip: Track these often-missed home office expenses:

- Internet service (business %)

- Utilities

- Home insurance

- Security systems

- Maintenance and repairs

Vehicle Expense Deductions

Vehicle deductions require careful consideration of two methods:

- Standard Mileage Rate:

Currently 58.5¢ per mile for 2024, this method works best for:

- High-mileage businesses

- Newer vehicles

- Simplified record-keeping needs

- Actual Expense Method:

Better for:

- Older vehicles

- Low-mileage situations

- When costs exceed standard rate

- Keep These Records:

- Mileage logs (digital preferred)

- Maintenance receipts

- Insurance documents

- Fuel receipts (if using actual expense method)

Industry-Specific Deductions

Different industries qualify for unique deductions. Understanding creative tax deductions for small business within your specific field can significantly increase your tax savings.

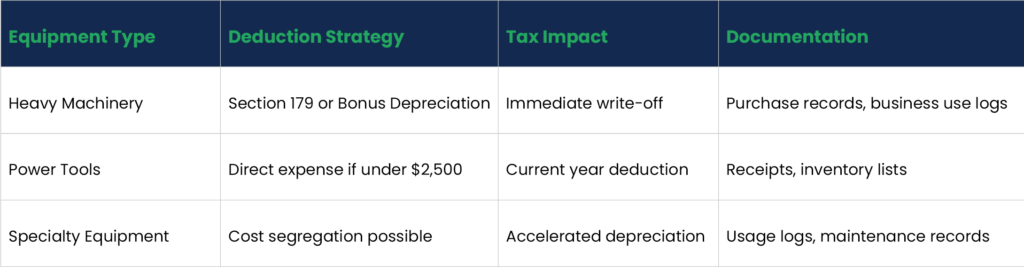

Construction Business Deductions

Construction businesses face unique opportunities and challenges with tax deductions. Heavy equipment investments and job site costs create substantial reduction potential.

Equipment Deductions:

Capital investments in construction require strategic planning. Here’s how to maximize these deductions:

Job Site Costs:

Construction sites generate numerous deductible expenses that many businesses overlook:

- Temporary Structures

- Storage containers

- Site offices

- Safety barriers

- Temporary utilities

- Safety and Compliance

- OSHA requirements

- Safety equipment

- Training programs

- Site security

Professional Services Deductions

Professional service businesses like consultants, lawyers, and accountants have distinct deduction opportunities focused on knowledge work and client relationships.

Professional Development: Your expertise is your product. These investments in maintaining and improving it are fully deductible:

Client Acquisition Costs: Building and maintaining client relationships creates several deduction opportunities:

- Marketing materials

- Networking events

- Client entertainment (50% limit)

- Professional references and resources

Digital Business Deductions

E-commerce and digital businesses have unique deduction opportunities in technology and online operations.

Platform Costs: Online businesses can deduct these essential operational costs:

Technology Stack: Digital businesses particularly benefit from software deductions:

- E-commerce platforms

- QuickBooks or Xero for financials

- Dext for expense management

- Marketing automation tools

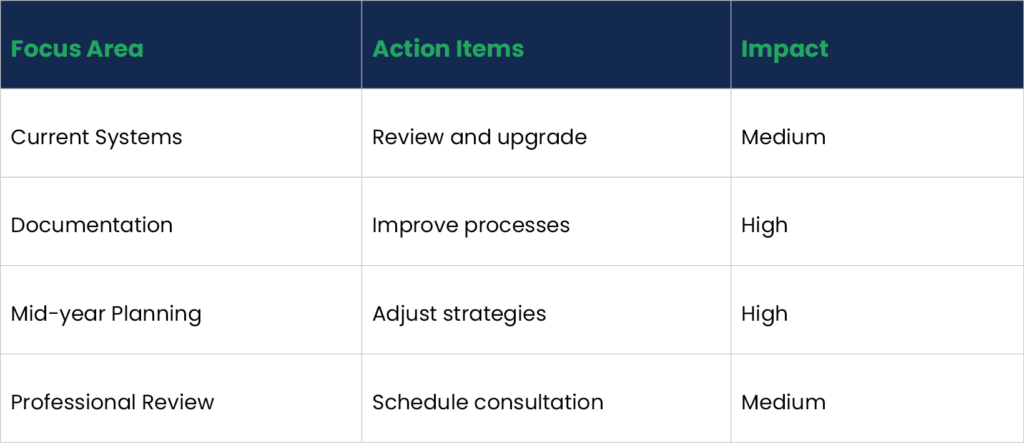

Strategic Tax Planning

Strategic tax planning turns good deductions into great savings. This section covers timing, documentation, and advanced strategies to maximize your tax benefits.

Seasonal Planning Considerations

Each quarter presents unique opportunities for tax planning. Here’s how to make the most of the tax calendar:

- Q1 (January-March): Start your tax year strong by focusing on fundamentals:

- Review previous year’s deductions

- Update accounting systems (QuickBooks or Xero)

- Implement or upgrade receipt tracking (Dext)

- Plan major purchases for the year

- Q2 (April-June): After tax season, focus on optimization:

- Q3 (July-September): This quarter is crucial for year-end planning:

- Project annual income

- Plan equipment purchases

- Review vehicle logs

- Schedule training and conferences

- Q4 (October-December): Make strategic moves before year-end:

- Time major purchases

- Accelerate necessary expenses

- Document all deductions

- Schedule professional review

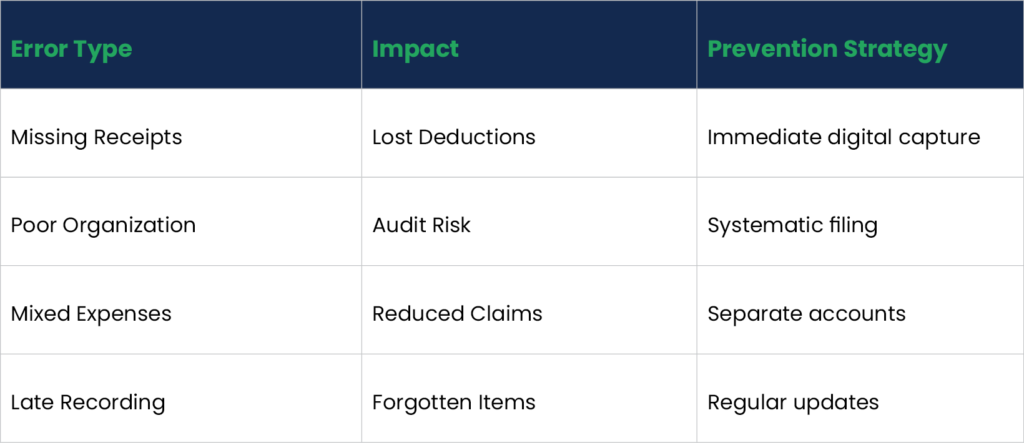

Documentation Strategies

Good documentation transforms possible deductions into actual tax savings. Create a system that works for your business style.

Essential Documentation Components:

- Digital Infrastructure

- Cloud storage for receipts

- Regular backup system

- Easy access for your tax professional

- Secure data protection

- Record Organization: Keep these records organized by category:

- Income documents

- Expense receipts

- Asset purchases

- Vehicle logs

- Meeting notes

Pro Tip: Use Dext to capture receipts immediately, then sync with QuickBooks or Xero for seamless documentation.

Common Mistakes to Avoid

Understanding common pitfalls helps protect your deductions:

Documentation Errors: Many businesses lose deductions through poor documentation. Avoid these mistakes:

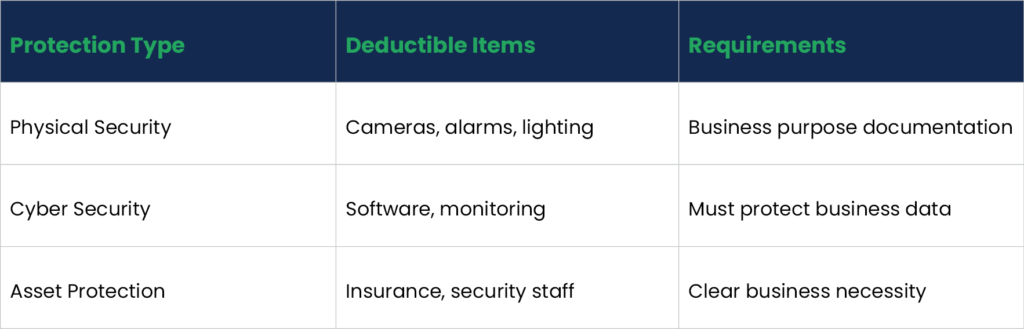

Advanced Tax Strategies

Beyond basic deductions, advanced creative tax deductions for small business can significantly reduce your tax burden while maintaining full compliance. Let’s explore sophisticated approaches that many businesses overlook.

Creative Yet Legal Deductions

Many legitimate deductions go unclaimed simply because they seem unusual. Here are some overlooked opportunities:

Business Protection Deductions:

These security-related expenses often get missed:

Wellness Program Deductions:

While general gym memberships aren’t deductible, structured wellness programs might qualify:

- Company-wide health initiatives

- Safety training programs

- Ergonomic office equipment

- Mental health support services

Timing Strategies

Strategic timing of expenses and income can significantly impact your tax savings:

Purchase Timing Example:

A Texas restaurant owner saved $12,000 by purchasing new kitchen equipment in December instead of January. This timing provided immediate tax benefits while meeting a business need.

Consider these timing opportunities:

- Equipment purchases

- Software subscriptions

- Maintenance contracts

- Professional service prepayments

Working with Tax Professionals

Professional guidance often pays for itself through additional savings. Know when to seek help:

Growth Indicators for Professional Help:

- Revenue exceeding $1 million

- Multiple state operations

- Complex transactions

- Rapid expansion plans

Your tax professional should provide:

- Year-round planning

- Industry-specific guidance

- Audit protection

- Strategic advice

Taking Action

Start maximizing your tax deductions today with these steps:

Immediate Actions:

- Download our “The Ultimate Financial Ratios Cheat Sheet For Small Business Success“

- Review current deductions

- Set up proper tracking systems

- Organize documentation

Next Week:

- Implement digital tools (Dext, QuickBooks, or Xero)

- Create expense categories

- Start tracking mileage

- Document business assets

Don’t leave money on the table. Contact us for a free tax assessment. Our team brings over 25 years of combined experience helping Texas businesses save money through smart tax planning. Schedule your free consultation today.

Remember: Good tax planning is an investment in your business’s future. Start implementing these strategies today to see the benefits all year long.

FAQs

Are accounting fees tax deductible?

Yes, professional accounting fees, including QuickBooks or Xero subscriptions and tax preparation services, are fully deductible business expenses.

Are bank charges deductible?

Yes, all business-related banking fees qualify as tax deductions, including monthly service charges, transaction fees, and merchant processing costs.

Are gym memberships deductible?

Generally no, unless part of a documented medical treatment plan or a structured employee wellness program available to all staff.

Are legal fees tax deductible for business?

Yes, legal fees related to business operations, contracts, and compliance are fully deductible.

Are office supplies tax deductible?

Yes, all necessary office supplies, including technology purchases and software subscriptions, are fully deductible when used for business.

Can I deduct the cost of my home office?

Yes, the home office deduction allows you to deduct a portion of your home expenses based on the space used for your business, either through a simplified method or the regular percentage-based method